The UAE Cabinet of Ministers issued Decision No. 49/2021 amending provisions of Cabinet Decision No. 40/2017 regulating tax penalties (the “new Decision”) dated 28th April 2021. These changes are effective 60 days from the date of the amendment (the original list of penalties is detailed HERE.)

Under the provisions, key changes are made to tax penalty regime for tax violations. These are designed to help taxable businesses that are unable to pay imposed retrospectively late-payment penalties for voluntary disclosures.

The resolution also seeks to encourage taxpayers to voluntarily correct previous tax declarations, as well as encourage them to pay due taxes before the tax audit or assessment by the UAE Federal Tax Authority (FTA).

Key highlights under the Decision include:

- Late payment penalties are reduced from 1% per day to 4% per month.

- 300% cap still applies.

- New starting date for calculating late payment penalties.

- Reductions for prior penalties are to be made.

- Effective sixty days as of 28 April 2021.

Penalty calculation

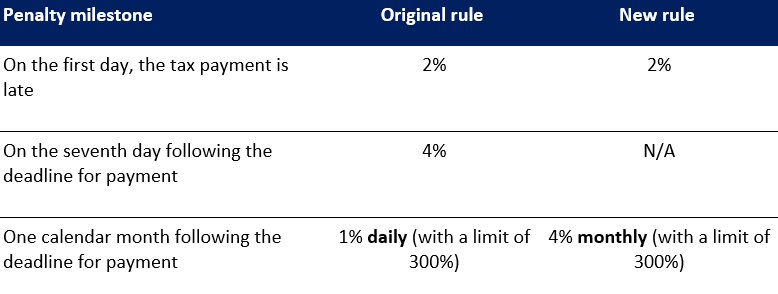

The key change affects late payment penalties. These are now reduced from 1% per day to 4% per month. The 300% cap on the late payment penalties still applies.

The new calculation of late payment penalties will be as follows:

- 2% of the unpaid tax immediately past the due date.

- 4% per month thereafter commencing a month after the due date.

In summary, the penalty changes are as follows:

Due date/start of penalties

The new Decision states that the due date to calculate late payment penalties shall be:

- 20 weekdays as of the date of submission of voluntary disclosure.

- 20 weekdays as of the date of receipt of a tax assessment.

The late payment penalties apply 20 weekdays from the date of submission of voluntary disclosure or receipt of a tax assessment, as opposed to retrospectively from the date of the original tax return. By doing so penalties will be levied 20 working days later than under the previous regime.

Relief for previous penalties:

Additional provisions grant the Federal Tax Authority the right to reduce previously unpaid penalties to 30% of the total where conditions are met:

- The penalties were applied under the previous Cabinet Decision No. 40/2017 regulating tax penalties.

- The registrant has paid all taxes due by 31 December 2021 at most.

- By 31 December 2021, at most, the registrant must have paid 30% of the total tax penalties owed until the coming into effect of the new Decision (i.e., sixty days as of 28 April).

The relief appears to apply to penalties that are still unpaid to the FTA before the effective date of the Cabinet Decision. Taxpayers who have already accounted for the FTA in respect of any imposed penalties are unlikely to be able to benefit from the relief. Further guidance from the FTA on the procedures for implementing this relief should be awaited.

Considerations for Taxpayers

Once Cabinet Decision No. 49 of 2021 comes into effect, the amendment provides businesses with both new opportunities and risks.

Disclosure

The new penalty structure encourages the early submission of voluntary disclosures by applying relatively low percentages of penalties submitted closer to the due date of the relevant tax return.

Conversely, greater penalties will apply where errors are discovered in the course of a tax audit (or disclosed after a taxpayer is notified of an impending audit). They will also accumulate from the due date of the relevant tax return.

Therefore, businesses must work towards identifying such errors and reporting them to the FTA before it is notified of any FTA audit.

To determine if a voluntary disclosure is required, businesses should conduct a VAT Health Check with a careful review of their VAT Returns to identify any errors – in particular, the periods where you foresee uncertainties relating to the VAT treatment of supplies or recovery of expenses.

Penalty Relief

Where a VAT-registered taxpayer has already been subject to penalties under the original penalty regime, you may benefit from the relief for existing penalties and reduce the amount still unpaid before the effective date.

Businesses should assess if they meet the conditions for the relief. It is noteworthy the amnesty does not apply where penalties have already been paid.

Accounting & Tax Services

As an approved FTA Tax Agency, SimplySolved supports businesses under advisory or complete outsource basis to optimise, manage and discharge tax obligation in the UAE. Our experts possess in-depth knowledge of the UAE tax regulations and can guide you through the intricacies of the UAE Corporate Tax Law.

By leveraging our expertise, you can streamline the process, saving time and minimizing the risk of errors. This proactive approach ensures that your Tax matter are handled efficiently, allowing you to focus on your core business activities.

Simply Solved is an ISO 9001 & 27001 certified company and a registered FTA Tax Agency. Our team of experienced consultants and tax agents provides high-quality, cost-effective services for all Tax matters for companies of all sizes.

Contact us today about working with a certified tax agency in the UAE.