Comprehensive financial reporting & financial management is essential for any business. As a small business, start-up, or entrepreneur, you may find challenges in managing your financial processes and reporting. Poor internal controls and reporting quality is a major risk for any business, especially as you rely on the reporting to make decisions. Good quality information helps to make better decisions.

Many companies opt to work with specialized outsourced partners to bring to bear expertise in performing those tasks. But what should you look for when working with an outsourced partner and what issues could this solve?

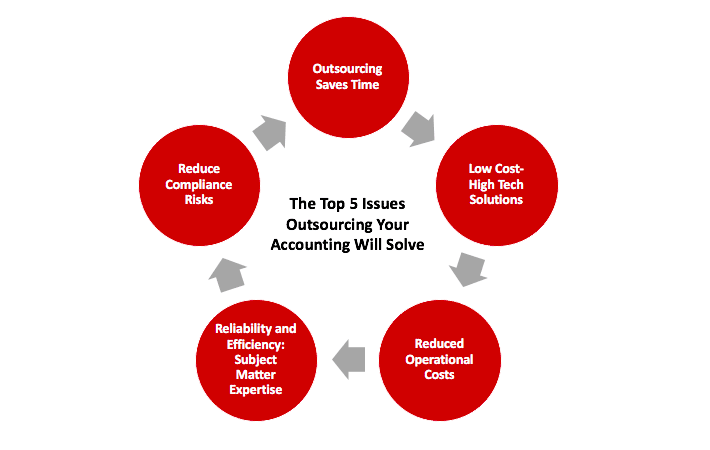

1. Outsourcing Saves Time

As a business owner, your time is better served marketing your products & services rather than entering accounting debits and credits. To properly manage finance workflows, you’ll need qualified employees. The risk is that they may not meet expectations and place demands on your cash resources.

Outsourcing your financial management and reporting or bookkeeping & Accounting Services will lift the burden of carefully implementing proper processes and leave the management of your tax and accounting services to qualified experts.

2. Low Cost- High Tech Solutions

When outsourcing, your company doesn’t necessarily need to buy the relevant accounting software or hardware for your accounting operations. A good outsourced accounting services provider should implement best-in-class accounting software with expertise in implementing it to best practices.

Your current financial processes could be improved to current standards without any extra effort, helping to provide more reliable information and comply with regulatory requirements. This can reduce costs, create better cash flow, and better position your growing company.

3. Reduced Operational Costs

Similarly, outsourcing your accounting will lower your total costs by avoiding expenses such as employee recruitment, visa costs, training, employee salaries, and accounting software. It is normal for businesses to save between 40-60% in operational costs.

4. Reliability and Efficiency: Subject Matter Expertise

As a business owner, it is easy to overlook the latest tax changes or rules that need to be managed. There is a risk that inaccurate or missed statutory compliance and reporting could expose the company to risks. These can result in fines and penalties under audit. It is less risky to allow experts to address these issues and leverage their team of skilled resources.

5. Reduce Compliance Risks

Many countries, including the UAE, are strengthening compliance and reporting as part of global initiatives under the OECD. Coupled with the introduction of taxation in 2018, your financial reports are the key asset to managing statutory reporting. It is risky to overlook the importance of proper compliance or face penalties. An experienced accounting outsourcing firm will assure your financial reports are well prepared and filed on time adhering to the legislation laws.

Outsourcing your accounting services presents a great opportunity for businesses to focus their time and resources to support business growth.

Your resources can work on expanding or creating better services/products. A reliable partner will reduce the challenges in implementing sound financial management processes and systems and reduce the risk of compliance errors.

Working with reliable accounting and bookkeeping firm is essential without concerns about the quality of your financial reports. It could transform any company’s finance function to help improve cash flow, profitability, and overall growth.

SimplySolved is one of the top accountancy firms in the UAE that consists of a team of experienced Accountants and FTA Tax Agents that carefully manage your accounting and tax requirements. Our approach is centered on quality ISO 9001, 27001 & 42001, best practice processes, and IT platforms to deliver results to your business. Offering best-in-class accounting services in UAE.

Accounting & Tax Services

As an approved FTA Tax Agency, SimplySolved supports businesses under advisory or complete outsource basis to optimise, manage and discharge tax obligation in the UAE. Our experts possess in-depth knowledge of the UAE tax regulations and can guide you through the intricacies of the UAE Corporate Tax Law.

By leveraging our expertise, you can streamline the process, saving time and minimizing the risk of errors. This proactive approach ensures that your Tax matter are handled efficiently, allowing you to focus on your core business activities.

Simply Solved is an ISO 9001 & 27001 certified company and a registered FTA Tax Agency. Our team of experienced consultants and tax agents provides high-quality, cost-effective services for all Tax matters for companies of all sizes.