In seeking to establish a competitive and dynamic economy, the UAE Government has sought to build an attractive investment environment to offer resident companies and individuals the benefits of its attractive tax environment.

The Ministry of Finance has over the last years agreed on Double Tax Treaties with a number of jurisdictions to minimise impacts from similar taxes imposed on the same taxpayer in both countries.

The UAE Double taxation is defined as when similar taxes are imposed in two countries on the same taxpayer on the same tax base, which harmfully affects the exchange of goods, services, and capital and technology transfer and trade across the border.

Public and private companies, investment firms, air transport firms, and other companies operating in the UAE, as well as residents, benefit from Avoidance of Double Taxation Agreements (DTA).

With the purpose of promoting its development goals, the UAE concluded 115 DTA with most of its trade partners.

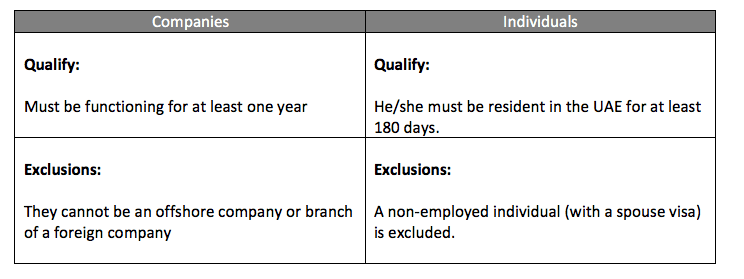

Who is Eligible Under Avoidance of DTA Agreements?

There are specific requirements to obtain a tax residency (Domicile) certificate in UAE issued by the International Financial Relations and Organisations Department.

In both scenarios, the applicant must provide the necessary documents to support and evidence their eligibility.

What Documentation is Required?

Depending on the applicant (as a company or individual) different documentation is required:

| Companies | Individuals |

| Trade License. Proof of Authorization (Establishment Contract or the Power of Attorney). Copy of the audited financial accounts certified by a certified audit firm. A bank statement issued by a local bank covering 6 months within the financial year related to the request. Certified copy of the Memorandum of Association (if applicable). | Passport. Valid Residence Permit. Emirates ID. A certified copy of residential lease agreement. Source of income/salary certificate. A bank statement issued by a local bank covering 6 months within the financial year related to the request. Entry and exit report from Federal Authority of Identity and Citizenship or a local competent Government entity. |

Failure to provide accurate and valid documentation can lead to delays and complications, therefore preparation is recommended with support from an experienced advisor.

What Jurisdictions are Applicable?

MoF is continuing to increase its arrangements with other tax jurisdictions, the complete list for December 2019 is listed below:

| Country | Entry into force | Country | Entry into force | Country | Entry into force |

| Albania | 3/26/2015 | Guinea | 7/9/2014 | Panama | 10/23/2013 |

| Algeria | 6/25/2004 | Guinea- Bissau | Paraguay | 1/20/2019 | |

| Andorra | 8/1/2017 | Hellenic | 12/16/2014 | Philippine | 10/2/2008 |

| Angola | 3/28/2020 | Hellenic (Protocol Amendment) | 12/16/2014 | Poland | 2/3/1994 |

| Antigua and Barbuda | 2/24/2022 | Hong Kong | 12/10/2015 | Poland | 5/1/2015 |

| Argentina | 1/20/2019 | Hungary | 10/4/2014 | (Protocol Amendment( | |

| Armenia | 1/11/2005 | India | 9/15/1993 | Portugal | 5/22/2012 |

| Austria | 9/23/2004 | India (Protocol) | 10/3/2007 | Republic of Congo (Brazzaville) | |

| Austria (Protocol Amendment) | India (Protocol) | 3/12/2013 | Romania (New) | 12/11/2016 | |

| Azerbaijan | 6/12/2007 | Indonesia (New) | 8/19/2021 | Russia | 6/23/2013 |

| Bangladesh | 6/13/2011 | Iraq | Rwanda | 12/4/2019 | |

| Barbados | 2/18/2016 | Ireland | 7/19/2011 | Saint Kitts and Nevis | |

| Belarus | 2/1/2001 | Israel | 12/29/2021 | Saint Vincent and the Grenadines | |

| Belarus (Protocol Amendment) | 5/1/2020 | Italy | 10/5/1997 | San Marino | |

| Belgium | 12/22/2003 | Jamaica | Senegal | 7/2/2017 | |

| Belize | 10/24/2017 | Japan | 12/24/2014 | Serbia | 7/2/2013 |

| Benin | Jersey | 9/25/2017 | Seychelles | 4/14/2007 | |

| Bermuda | 7/5/2019 | Jordan | 1/10/2017 | Sierra Leone | |

| Bosnia and Herzegovina | 5/19/2009 | Kazakhstan | 11/27/2013 | Singapore | 7/18/1996 |

| Botswana | 3/27/2020 | Kenya | 2/22/2017 | Singapore Protocol Second Amendment | 3/16/2016 |

| Brazil | 3/15/2021 | Kingdom of Saudi Arabia | 1/1/2020 | Slovak | 4/1/2017 |

| Brunei Darussalam | 11/21/2014 | Korea | 3/9/2005 | Slovenia | 9/29/2014 |

| Bulgaria | 11/16/2008 | Korea | 2/29/2020 | South Africa | 11/23/2016 |

| Burkina Faso | Kosovo | 7/3/2017 | South Sudan | ||

| Burundi | Kyrgyzstan | 12/16/2015 | Spain | 4/2/2007 | |

| Cameroon | 7/8/2021 | Latvia | 6/11/2013 | Sri Lanka | 7/4/2004 |

| Canada | 5/25/2004 | Lebanon | 3/23/1999 | Sudan | 6/6/2004 |

| Chad | Liberia | Suriname | |||

| Chile | 7/28/2022 | Switzerland | 10/21/2012 | ||

| China | 7/22/1994 | Libya | Switzerland (Protocol) | ||

| Colombia | Liechtenstein | 2/24/2017 | Syria | 1/12/2002 | |

| Commonwealth of Dominica | Lithuania | 12/19/2014 | Tajikistan | 3/27/2000 | |

| Comoro Islands | 1/2/2018 | Luxembourg | 6/19/2009 | Tanzania | |

| Costa Rica | 6/9/2021 | Luxembourg (Protocol Amendment( | 1/1/2016 | Thailand | 1/4/2001 |

| Cote D’ivoire | Macedonia | 2/7/2017 | The Co-operative Republic of Guyana | ||

| Croatia | 1/1/2019 | Magnolia | 2/24/2004 | Tunisia | 5/27/1997 |

| Cyprus | 3/17/2013 | Malaysia | 9/24/1996 | Turkey | 1/29/1995 |

| Czech | 1/1/2005 | Maldives | 8/9/2018 | Turkmenistan | 12/30/2011 |

| Mali | Turkmenistan (Protocol Amendment) | 2/5/2019 | |||

| Czech (new) | Malta | 9/13/2006 | Uganda | ||

| Democratic Republic of the Congo | 1/24/2023 | Mauritania | 7/18/2019 | Ukraine | 3/9/2004 |

| Ecuador | 8/1/2021 | Mauritius | 9/25/2007 | Ukraine | |

| Egypt (New) | 4/19/2021 | Moldova | 7/26/2018 | (Protocol Amendment) | |

| Equatorial Guinea | Monaco | United Kingdom of Great Britain and Northern Ireland | 12/25/2016 | ||

| Estonia | 3/29/2012 | Montenegro | 2/11/2013 | United Mexican States | 7/9/2014 |

| Ethiopia | 11/6/2018 | Morocco | 7/1/2000 | Uruguay | 6/14/2016 |

| Fiji | 12/20/2013 | Mozambique | 6/4/2004 | Uzbekistan | 2/25/2011 |

| Finland | 12/26/1997 | Netherlands | 6/2/2010 | Venezuela | 6/20/2011 |

| France | 11/8/1994 | New Zealand | 7/29/2004 | Vietnam | 4/12/2010 |

| Gabon | 2/16/2023 | Niger | 8/18/2021 | Yemen | 1/1/2004 |

| Gambia | Nigeria | Zambia | 1/13/2023 | ||

| Georgia | 4/28/2011 | Pakistan | 11/20/2000 | Zimbabwe | 2/7/2021 |

| Ghana | Palestine |

Accounting & Tax Services

As an approved FTA Tax Agency, SimplySolved supports businesses under advisory or complete outsource basis to optimise, manage and discharge tax obligation in the UAE. Our experts possess in-depth knowledge of the UAE tax regulations and can guide you through the intricacies of the UAE Corporate Tax Law.

By leveraging our expertise, you can streamline the process, saving time and minimizing the risk of errors. This proactive approach ensures that your Tax matter are handled efficiently, allowing you to focus on your core business activities.

Simply Solved is an ISO 9001 & 27001 certified company and a registered FTA Tax Agency. Our team of experienced consultants and tax agents provides high-quality, cost-effective services for all Tax matters for companies of all sizes.

Contact us to speak to an experienced advisor.