The UAE is implementing e-invoicing for B2B and B2G through a phased programme led by the Federal Tax Authority (FTA) and Ministry of Finance (MoF). Pilot and voluntary adoption begins on July 1, 2026; mandatory phases follow in 2027 under Federal Decree Laws 16 and 17 of 2024. The objective is to modernize tax systems, improve transparency, and align with global e-invoicing frameworks such as Peppol.

Zoho Books, when configured by qualified Premier implementation partners such as SimplySolved, offers a scalable and compliant solution to support this transition.

This article covers the e-invoicing rollout phases, key FTA updates, and how Zoho Books helps ensure compliance.

UAE E-invoicing Timeline: What Businesses Need to Know

The Federal Tax Authority has planned the e-invoicing rollout in three main phases to help businesses prepare effectively.

Phase 1: Foundation (Q4 2024)

- Release of accreditation guidelines for Accredited Service Providers (ASPs)

- Publication of technical specifications for system integration

- Initial publication of the ASP list on the MoF e-invoicing portal, with OpenPeppol five-corner model and data dictionary preparation (PINT AE) for structured exchange and reporting to the FTA (B2B and B2G focus)

Phase 2: Legislative Finalisation (Q2 2025)

- Final e-invoicing laws issued

- Official notifications sent to taxpayers

- Testing platform for the FTA e-invoicing system goes live

- Ministerial Decisions No. 243 and No. 244 of 2025 issued, including scope of transactions and implementation rules, and Cabinet Decision No. 106 of 2025 for administrative penalties

Phase 3: Mandatory Compliance (Starting July 2026)

- Pilot and voluntary adoption begins 1 July 2026 for eligible taxpayers, using ASPs and structured formats (XML or JSON in UBL or PINT AE)

- Large taxpayers with annual revenue ≥ AED 50 million must appoint an ASP by 31 July 2026 and adopt mandatory e-invoicing from 1 January 2027 for B2B and B2G transactions

- SMEs and mid-sized companies with annual revenue < AED 50 million must appoint an ASP by 31 March 2027 and adopt mandatory e-invoicing from 1 July 2027 for B2B and B2G transactions

- UAE government entities must appoint an ASP by 31 March 2027 and adopt mandatory e-invoicing from 1 October 2027 for B2G

- B2C transactions remain out of scope initially and will be brought in through later decisions by the MoF or FTA

- Sandbox environment open from July 2026 for large taxpayers to test compliance with ASPs and FTA APIs, including exchange and near real-time reporting through the OpenPeppol network

To clarify coverage and deadlines, the following table sets out the phases by effective date, revenue thresholds, sector scope, and the dates to appoint an Accredited Service Provider (ASP).

| Phase | Effective Date | Who is covered | Transaction scope | Deadline to appoint ASP | Notes |

| Pilot | July 1, 2026 | Selected group of businesses | B2B and B2G (voluntary) | N/A | Pilot begins via ASPs. Use structured XML or JSON in UBL or PINT AE. |

| Phase 1 | January 1, 2027 | Businesses with annual revenue ≥ AED 50 million | B2B and B2G (mandatory) | July 31, 2026 | Mandatory e-invoicing through Accredited Service Providers. |

| Phase 2 | July 1, 2027 | Businesses with annual revenue < AED 50 million | B2B and B2G (mandatory) | March 31, 2027 | Mandatory e-invoicing through Accredited Service Providers. |

| Phase 3 | October 1, 2027 | All government entities | B2G (mandatory) | March 31, 2027 | Government entities adopt mandatory e-invoicing via Accredited Service Providers. |

Large businesses should start testing in the sandbox to ensure systems and processes meet FTA requirements before mandatory compliance begins.

Key Compliance Requirements for UAE E-Invoicing

All VAT-registered businesses in the UAE must align their invoicing processes with the technical and procedural standards issued by the Federal Tax Authority (FTA). These requirements are central to the shift toward real-time, digital invoice reporting.

Use of Structured Digital Formats

Invoices need to be created in either XML or JSON format using recognised standards like UBL or Peppol. The UAE has adopted a localized schema called PINT AE, which outlines how invoice data should be organized. This ensures that systems can read and exchange invoice information accurately and consistently.

Exchange and Reporting Through ASPs

Invoices are exchanged and reported via Accredited Service Providers under the Open Peppol five corner model. ASPs validate invoice data against UAE technical rules and transmit it to MoF/FTA according to programme specifications.

Data Validation and Audit Trail

ASPs check that invoices meet the FTA’s technical standards before forwarding them. Each invoice must include an audit trail that records key events from issuance to submission. This helps maintain transparency and supports compliance reviews. If any required data is missing or incorrect, the invoice must be fixed before it’s accepted.

These compliance requirements are based on the PINT AE data dictionary published for consultation in February 2025 and the PINT AE specifications released in June 2025, which define mandatory, conditional and optional fields across common invoice and creditnote use cases.

Understanding and implementing these standards will be key for businesses preparing for mandatory e-invoicing.

How Integrated Tools Such As Zoho Books Support UAE E-Invoicing Compliance

As businesses prepare to meet the UAE’s structured e-invoicing standards, accounting systems must adapt to support real-time compliance.

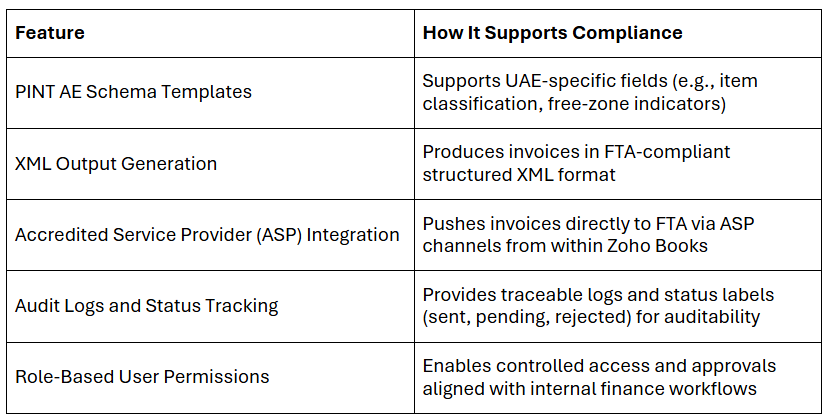

Zoho Books, already certified by the FTA as a Digital Tax Integrator, has introduced new e-invoicing capabilities that align with the latest mandate. Below is a summary of how it supports compliant e-invoicing workflows:

Zoho Books vs Traditional ERP Systems: How Different Solutions Support UAE E-invoicing

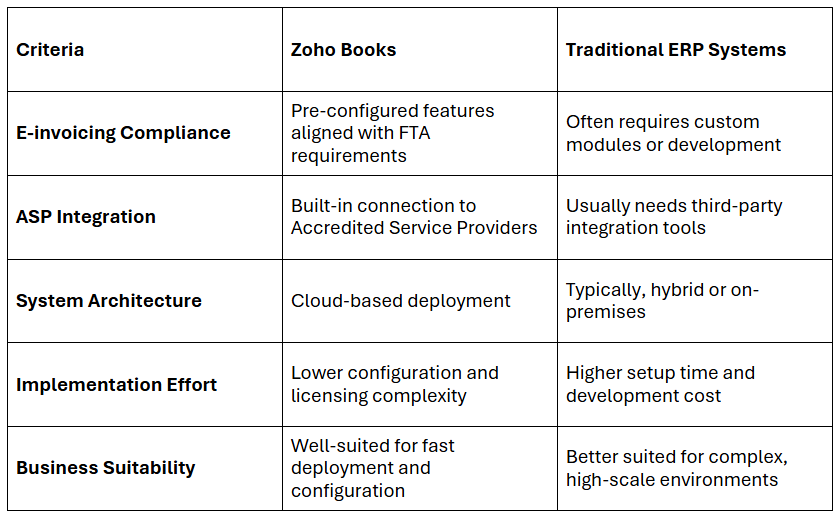

Choosing the right software to support UAE e-invoicing compliance requires evaluating how well each system meets the technical, integration, and cost expectations defined by the Federal Tax Authority (FTA). The table below outlines how Zoho Books compares to traditional ERP platforms.

This comparison highlights how certain platforms, such as Zoho Books, may simplify the adoption of e-invoicing requirements through pre-aligned features and reduced integration steps, especially for businesses seeking to meet compliance deadlines efficiently.

Preparing for UAE E-invoicing Compliance with Zoho Books

Zoho Books is rolling out features aligned with the UAE’s e-invoicing requirements. The checklist below outlines key steps for businesses to align systems, data, and teams with FTA compliance standards:

1. Review System Capabilities

– Ensure Zoho Books supports the PINT AE schema and generates FTA-compliant XML output.

– Confirm customer, supplier, and item data is complete and correctly mapped.

2. Appoint an Accredited Service Provider (ASP)

– Select an ASP listed on the FTA portal.

– Verify compatibility with Zoho Books and access to required integration resources.

3. Use the FTA Sandbox (If Applicable)

– Conduct testing through the FTA sandbox to validate invoice formatting and submission.

– Assess system responses to validation errors and invoice rejections.

4. Train Internal Teams

– Ensure finance and IT teams understand updated workflows in Zoho Books.

– Establish procedures for handling validation issues and rejected invoices.

5. Monitor Regulatory Updates

– Track FTA guidance on timelines, schema revisions, and rollout phases.

– Update system configurations and internal processes as needed.

6. Prepare for Go Live

– Finalize deployment with defined KPIs and review process.

– Set up dashboards and alerts in Zoho Books to monitor invoice status (sent, accepted, rejected) and maintain submission accuracy.

Conclusion

UAE einvoicing begins with pilot adoption in July 2026 and becomes mandatory in phases during 2027 for B2B and B2G. Businesses using Zoho Books can prepare by enabling structured XML output, aligning invoice fields with PINT AE, and integrating with an Accredited Service Provider. Testing in the pilot and training internal teams will help ensure accurate submission and system readiness.

About SimplySolved

As an FTA-Approved Tax Agency with ISO 9001, 27001, and 42001 certified services, SimplySolved helps your business meet e-invoicing, VAT, and Corporate Tax obligations with confidence. As a certified Zoho Partner, we support you in configuring Zoho Books for full PINT AE compliance, integrating with an Accredited Service Provider (ASP), and training your finance and IT teams to manage new workflows effectively. With SimplySolved, you stay aligned with evolving FTA requirements while maintaining control over your financial operations.