Overview

Recently, we requested input to understand the challenges for businesses in working with available official VAT online resources in the UAE.

For any businesses ensuring key personnel is fully equipped is essential to avoid misinterpretations that may come to light under an audit and incur penalties.

Therefore, we asked respondents several pertinent questions to assess how effective these resources are to build effective uae VAT understanding and implementation approach to their business.

The survey sought to probe the availability and ease of use of online resources. Our goal was to identify gaps with current FTA online resources and help businesses bridge any shortfalls.

In this blog, we share the results of the survey.

Research Methodology

Our survey was sent to a broad section of the UAE economy totaling 12,987 businesses from which 457 (3.5%) returned completed answers to 3 key questions. The response criteria were set to a standard 5-point scale where:

1= Easy/No Value

5= Complicated/High Value

In addition, a comment section was provided for additional feedback to aid a qualitative understanding of a business’s issues.

Question 1

How do you find working with the FTA resources to answer VAT impacts to your business?

This question was designed to assess whether businesses fully recognise how their legislative review should be conducted:

- Across several published resources rather than a single document

- Whether the resources are complete and can be navigated easily

It is a common error to focus on one statute in the legislation.

This has inherent risks in building a complete understanding of the legislative requirements.

Best practice requires a defined approach that should be formed through careful analysis of all the various statutes and supporting clarifications.

Summary Findings

Most respondents show positive responses on the availability and completeness of resources published by the FTA.

The main area of dissatisfaction is the fragmentation of resources which complicate the ability to connect relevant resources in building a complete understanding of the prevailing legislation.

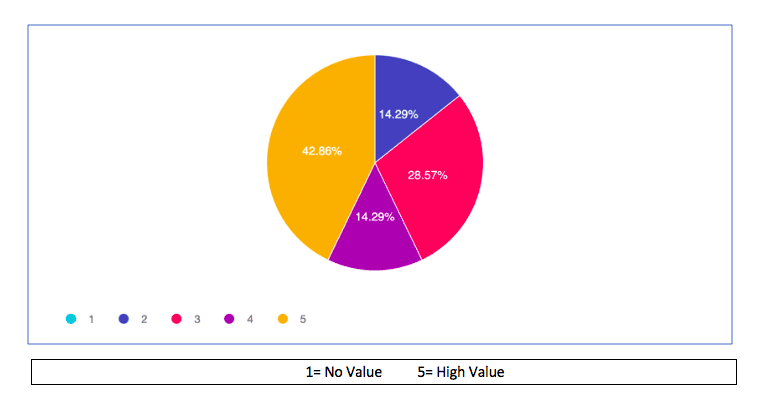

Question 2

If you had a centralized repository that provides structure to all Tax legislation and resources, would this be of value?

In line with the previous question, the objective in this question was to:

- Probe the benefit and value in an indexed repository that connects the various parts of the statutes

- Whether this would improve understanding of the legislation and increase productivity

- How this could address ongoing compliance in the event of clarifications and notices

Summary Findings

Respondents show positive feedback to the available resources availed by the FTA site. However, we observed a high level of positive feedback for a consolidated repository to reduce the effort to review all sections for specific considerations.

Question 3

If this included Tax legislation for other GCC jurisdictions, would this be of value?

The GCC framework legislation is based on the notion of harmonised VAT regime operating across the GCC. When this is implemented, the impacts to businesses supplying and purchasing from member states will entail additional requirements.

Therefore, this question seeks to establish whether UAE businesses have any focus to build a wider understanding of VAT impacts across the GCC currently and in the future.

Summary Findings

The responses may reflect the locally-focused nature of some respondents where a GCC wide business focus may be limited.

However, a clear requirement is shown where a wider understanding of GCC jurisdictions is required ideally in the same resource structure to improve productivity and aid navigating country-specific resources.

Currently, other jurisdictions operate their own communication and publication model to resources that could be time-consuming.

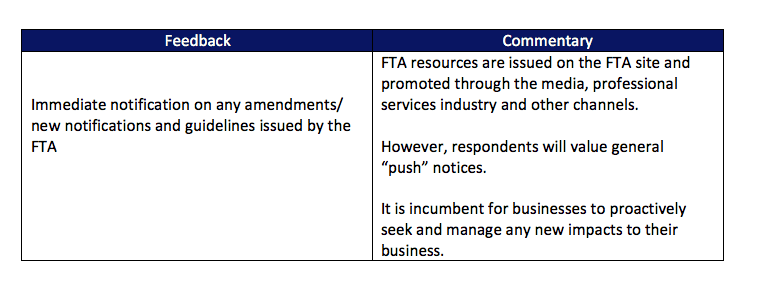

Qualitative Respondent Feedback

A free format section was added to our research approach to solicit additional feedback on specific benefits from respondents.

Naturally, feedback varied from issues specific to transactional understanding to processes in managing VAT registration, compliance and reporting.

These were considered out of scope in the scope of this research and are excluded from the final analysis.

The most prevalent and relevant feedback was on FTA communications was:

Summary

Our research infers the available online resources reasonably satisfy finance professionals to gather relevant information for investigation. It also recognises Legislative bodies that have sought to publish resources to enable businesses.

The major findings from respondents center around several themes:

- Resources are standalone assets– It is incumbent on users to investigate all documents to determine relevance to their business and build a complete picture of VAT implementation. Assets are unconnected which could lead to missed reviews of key statutes or references.

- Resources require constant review. Updates to key articles through clarifications or references to other publications are unconnected. Updates and interpretations of updates to prior legislation are not proactively communicated.

- GCC wide resources require separate research – Other Tax Authorities have their own approach to structuring online resources with different materials available. Therefore, a protracted exercise is likely to build an effective understanding of different jurisdictions.

In summary, a more indexed and related repository that consolidates online resources across the GCC jurisdictions in one format would be of value if supplemented by proactive notices to highlight impacts from new notices or clarifications.

In light of this research, we are pleased to announce the launch of such a repository to initially help UAE businesses and will extend to other jurisdictions.

For further information, please click on the following link: