Internal Audits – Why They Work?

Dec 23,2020 / Haroon Juma / Auditing Blogs

As a business owner managing the many aspects of your business is a complex and time-consuming process. It can be difficult to remain fully informed on all the details. It is natural to rely on your company’s processes, system, and people to manage day to day operations.

However, all too often a business will experience surprises where inadequate internal controls and policies report unreliable business performance. This can present an inaccurate understanding of your business risks.

An internal audit can provide greater clarity. Through an internal audit, you can assure your long-term sustainability and reinforce the quality of your processes and controls.

Internal Audit vs External Audit

Internal audits should never be confused with external audits. Although there are a few similarities, the main objectives are quite different.

An external audit is primarily focused on the reliability of internally prepared financial statements by an approved auditor that conducts an audit to recognized financial standards. This is solely focused on the financial statements. Occasionally, an auditor may qualify financial statements to highlight issues that impair the accuracy of the financial statements.

These audits do not take a deeper look at internal processes, controls, and risks that may affect the strength of operation and financial processes. This is where an internal audit comes into greater focus.

In large companies, this is a “throughout the year” process managed by a dedicated internal function. In smaller businesses, a qualified external auditor will bring to bear proven methodology and skills to identify risks for management attention.

What is Internal Audit?

Internal Audit is concerned with evaluating and improving the effectiveness of risk management, control, and governance processes in the organization.

In simple, the main purpose of an internal audit function is to assure that the financial, operational, and strategic profile of the organization adheres to the achievement of the business’ objectives. It seeks to identify risks and provide recommendations and controls that impact the organisation’s performance. It also provides guidance on streamlining processes to make them more efficient and risk-free.

What Should You Consider?

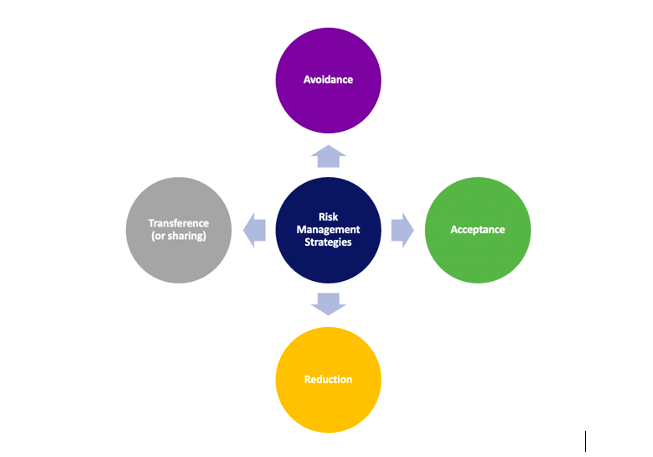

If your business is seeking external expertise, a qualified auditor with a proven methodology such as TARA (Transference Avoidance, Reduction or Acceptance) for managing risks should be applied.

The core objective is to identify risks to the implementation of the policies established by an organization and identify any loopholes in those policies. Generally, an auditor looks closely at the way operations are carried out and notes down the procedures, and matches them with the policy made by the organization.

If the auditor witnesses something that is not carried out in accordance with the policies, they will mark it against his quality control review checklist and look for reasons why the organization deviates from the documented policy.

There might be cases where the documented policy no longer works well. If this is the case, the deviation is “all good” provided it better helps in achieving required objectives. In such a case the auditor will recommend updating the policy document. The auditor may also contribute to further improving the newly adopted procedures.

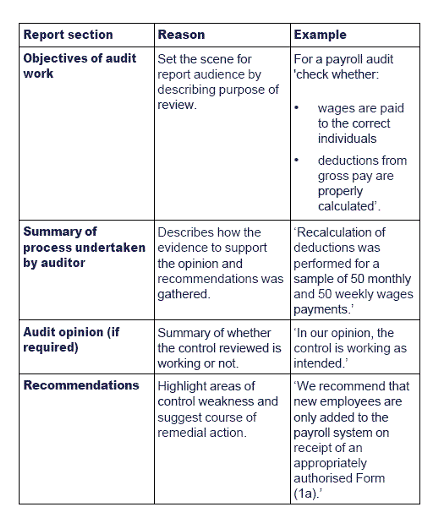

Once an internal control audit (or any other kind of audit) has been completed, the final stage of the assignment is the audit report.

The audit report does not have a prescribed format; however, it would be expected to feature several different parts.

How much depth the report goes into will depend on the nature of the engagement.

When making recommendations auditors must always ensure that the recommendations:

- are practical and cost effective, and

- will reduce risk to a tolerable level.

The auditor should have a process of post-implementation review to ensure that recommendations have been actioned by management.

Benefits of Internal Audit

There are numerous benefits of internal audits. The most important is the smooth compliance with the top management’s policies through proper monitoring of the processes.

Monitoring process will ensure the security of the “money profile” of an organization in numerous ways. For example, if the organization’s policy is to revalue an asset after receiving proper bids but does not do so, there is a high risk that the asset has an inaccurate effect on the financial reports. As a result, this would undervalue assets which affect the ability to raise capital.

Another important benefit of internal audits is that it supports better external audits. This is because internal functions follow all the policies in place and alter them if needed, for improvements to get the best possible results.

Strong controls play a vital role in an unqualified audit report. When effective controls are in place, the external auditors will rely on them and avoid substantive procedures.

If your business wants to assess and improve its internal controls and processes, we deliver quality processes and robust methodologies to provide insightful and practical guidance.

As a certified ISO 9001 Quality & 27001 Information Security firm and approved FTA Tax Agency, we deliver to standards your business can rely on across a range of services from advisory, outsourcing, and IT project delivery. Contact us to speak to our consultants :

Call us at 043445338 or Visit us at www.simplysolved.ae

About SimplySolved

At SimplySolved, we save your time, resources, and costs. Whether you need help with Outsourced Accounting, Finance, Corporate Tax, Employee Management & Payroll and ERP & E-Commerce Integration. we have the expertise and solutions to help.

Subscribe to mailing list

Partner With SimplySolved

Serving over 300+ clients we know the challenges your business faces operating cost effective, compliant and efficient back office operations.

As an FTA Accredited Tax Agency with ISO 9001 Quality & 27001 Information Management Certification, we offer a quality-based approach to our services supported by dedicated team of certified professionals.

We support our clients with defined processes, platforms and expertise to deliver advisory, project and outsourced services in Accounting, Tax, Auditing, HRM & Payroll & ERP solutions. Our offerings are specially designed to meet the UAE Regulations to put you in control of your information, comply to the legislation and help you make better business decisions.

Copyright © 2024 | SimplySolved | All Rights Reserved.