Operating From a Freezone? VAT Obligations & Opportunities

July 31,2019 / Haroon Juma / Marketing Blogs

Operating From a Freezone? – VAT Obligations & Opportunities

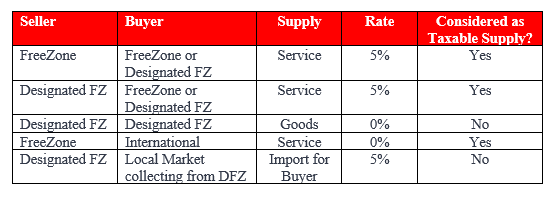

Freezone companies enjoy a special position in the UAE economy and considerations are made for VAT compliance and reporting obligations in the Legislation. Specifically, goods sold between Freezones were provided exceptional treatment for VAT. In the legislation, the notion of Designated Freezones was specifically defined. This allowed “out of scope” treatment of goods under a variety of transactions from and between Designated Free Zones.

Such zones are defined as specific fenced geographic areas which conform to greater security procedures with customs controls in place to monitor the movements of individuals and goods to and from the areas. Additionally, they have internal procedures regarding the method of keeping, storing, and processing goods.

There are over 45 Free Zones in the UAE, however, only 20 were named Designated Zones. Therefore, for VAT purposes, the rest of the free zones are considered in the UAE mainland.

Are You Still Obliged To Comply?

Many companies registered and received their Tax Registration Number during the introduction of VAT. This prudent measure was taken to comply before the actual understanding of VAT and its implications for the business became clear. Now that the specific categorization of your supplies is better understood, you may not be eligible for VAT and may be compelled to deregister.

Out of scope supplies are not considered under the VAT Legislation. Therefore, if your entity only conducts 100% of its business selling goods from a designated Free Zone and transits goods to customers outside of the UAE, you may not be subject to the VAT Legislation.

Under the provisions stated in Violations and Administrative Penalties related to the Implementation of the Federal Law No. (7) of 2017 on Tax Procedures, not deregistering when required to do so carries an AED10,000 penalty.

The primary question is assessing whether your business qualifies at the required threshold for taxable supplies. Taxable supplies have defined as all forms of supply of goods or services supplied by a registered taxable person in the State of UAE for consideration and in the course of conducting a business.

In the UAE, companies have to consider the VAT treatment of transactions with Designated Zones and assess their eligibility to comply with the VAT obligations.

If your taxable supplies may fall below the mandatory threshold, you should deregister.

To assure the FTA your de-registration request is valid, you will need thorough preparation of the necessary documentation to present a clear case. This should set out the taxable supplies that may require a range of supporting documents from invoices to financial and bank statements.

Failing to accurately record and present the supporting documentation to justify your taxable supplies can lead to issues and delays. Naturally once your TRN is cancelled, you become ineligible to reclaim VAT in expenses.

What If You Still Need To Comply and Want to Reduce Costs and Risks?

In the event your taxable supplies still exceed the mandatory threshold, you must continue to comply with the Legislation.

It is advisable to assess your compliance model to ensure risks are reviewed, corrective actions are taken, and costs are optimized. This assessment should include:

- Accurately recording transactions

- Adherence to contractual terms

- Recovery processes and policies

- Review and reporting processes

- Supporting documentation requirements

- IT platform, automating and supporting FTA Audit File (FAF) functionality

These are not an exhaustive list and further considerations based on the nature of your business should be taken into account. Under your VAT health check, improving your compliance model and processes will present opportunities for cost and risk reduction through process efficiencies and IT automation.

Summary

From our experience, these discussion points can improve the success of your VAT model, managing costs and risks.

You may be faced with other challenges from a technical or business standpoint. However, in our experience, these factors represent the main areas for risk and cost improvement which can be better managed by:

- Reviewing your challenges in the previous year

- Implementing better controls and reviews

- Filling capability gaps and resourcing appropriately

- On-going training and development

- IT automation and reporting

As your business assesses its performance or issues annually these suggestions do not necessarily lead to major demands on your resources or investments. They may in reality be targeted changes to yield major benefits.

If you require validation of your compliance model and reduce costs, we can support you to operate with greater confidence.

About SimplySolved

At SimplySolved, we save your time, resources, and costs. Whether you need help with Outsourced Accounting, Finance, Tax, Employee Management & Payroll and ERP & E-Commerce Integration. we have the expertise and solutions to help.

Subscribe to mailing list

Partner With SimplySolved

Serving over 300+ clients we know the challenges your business faces operating cost effective, compliant and efficient back office operations.

As an FTA Accredited Tax Agency with ISO 9001 Quality & 27001 Information Management Certification, we offer a quality-based approach to our services supported by dedicated team of certified professionals.

We support our clients with defined processes, platforms and expertise to deliver advisory, project and outsourced services in Accounting, Tax, Auditing, HRM & Payroll & ERP solutions. Our offerings are specially designed to meet the UAE Regulations to put you in control of your information, comply to the legislation and help you make better business decisions.

Copyright © 2024 | SimplySolved | All Rights Reserved.