How Can You Assure Transactional VAT Accuracy In Your IT System?

August 27,2019 / Haroon Juma / VAT & Tax Blogs

In our earlier blog, we discussed the probable approach the FTA may take to undertake an audit. During a desk based audit, the FTA will focus on the transactions in your IT application

Best practice recommends your IT should set up relevant tax codes and reporting enhancements in your IT system. This should be complemented by training your AR & AP teams and implementing governance processes to manage your operations processes.

Ideally, your IT system is the single source of truth for your transactional VAT treatment and reporting. Nevertheless, most enterprises face accuracy challenges where human decision making is required to define transactional VAT treatment.

For large enterprises with a large volume of transactions, this can be a larger issue. In this blog, we discuss the issues and implications for enterprises to maintain transactional VAT integrity to show credibility under an FTA audit.

1. Batch Reviewing Is Incomplete

As a tax consultant, VAT is an added complication that can stretch your team’s capabilities and resources.

Under these pressures, it is usual to focus on probable risk areas. Then sample test tax postings prior to calculating your return calculations. This can be a time-consuming process requiring transactional VAT analysis for each posting.

If your enterprise generates a high volume of transactions, the greater the risks as you may not have time or resources to check every posting.

Therefore, batch-based review approaches build risks that may be uncovered during audits.

2. Offline Reporting Is A Risk

Under the premise your IT system is a credible source of transactional accuracy, exporting your data and undertaking your VAT reporting calculations offline has inherent risks and issues.

Offline calculation may be an expedient solution if your reporting solution is less functional, however, there are clear and obvious issues. It can be challenging to:

- reconcile to source transactions from excel workings

- assure sufficient time and resources while your understanding is fresh to ensure your return agrees with your internal data

Therefore, offline report calculations can compound the transactional accuracy in your IT application and create further stress on internal resources.

3. Quality & Speed Matters

For any enterprise, the goal is to ensure transactional level tax treatment is accurate in your IT application at the source. To fully assess the quality of your enterprise VAT model, you should seek to ask a few salient questions:

- Are all transactions accurately allocated for tax treatment?

- Can this be relied upon to generate an accurate tax report from your IT system?

- Is the VAT model operating at the lowest cost of ownership?

- Can we satisfy responding to FTA queries confidently and responsively to demonstrate credibility?

To answer these questions, your business should assess additional capabilities and tools to address these questions satisfactorily. By taking this approach, you could also improve the efficiency of your finance team and processes. So, what options could you consider?

4. Options To Consider

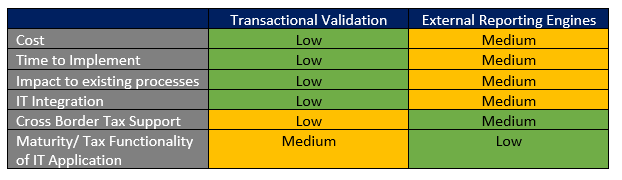

From an IT tools standpoint to achieve greater accuracy for transactional coding, your business may be presented with two broad approaches:

- An external reporting engine to control your VAT reporting model integrated into your IT application

If your enterprise has sufficient IT expertise and budget, you could invest in an external compliance and reporting platform. This option requires careful consideration of the sustainability and timescale for deploying a solution when integrating two separate IT systems.

- Or transactional validation tool to analyse your accounting entries in your IT system and identify errors for correction in source data

The validation approach is a cost effective and easy to deploy solution which relies on your internal IT having the necessary reporting functionality. This is the fastest and simplest option that will incur the smallest impact on your finance and IT functions

Below represent high-level qualitative benefits of either approach:

To manage your VAT obligations, deliver accurate VAT filings, get accurate VAT reporting and support a credible response to FTA, your IT system and supporting transactional postings are critical components to achieving these goals.

For finance teams to verify accuracy for postings, particularly on AP entries is an onerous task if undertaken manually for large volumes of transactions. Therefore, complementing your process with additional tools can make the difference to improve data quality and internal efficiency in your VAT reporting cycle.

If your business is seeking to improve your VAT model and systems, we have the platforms and capabilities to support you. Our solutions are state of the art, designed to the UAE legislation, and support your finance processes with minimal impacts.

About SimplySolved

At SimplySolved, we save your time, resources, and costs. Whether you need help with Outsourced Accounting, Finance, Tax, Employee Management & Payroll and ERP & E-Commerce Integration. we have the expertise and solutions to help.

Subscribe to mailing list

Partner With SimplySolved

Serving over 300+ clients we know the challenges your business faces operating cost effective, compliant and efficient back office operations.

As an FTA Accredited Tax Agency with ISO 9001 Quality & 27001 Information Management Certification, we offer a quality-based approach to our services supported by dedicated team of certified professionals.

We support our clients with defined processes, platforms and expertise to deliver advisory, project and outsourced services in Accounting, Tax, Auditing, HRM & Payroll & ERP solutions. Our offerings are specially designed to meet the UAE Regulations to put you in control of your information, comply to the legislation and help you make better business decisions.

Copyright © 2024 | SimplySolved | All Rights Reserved.