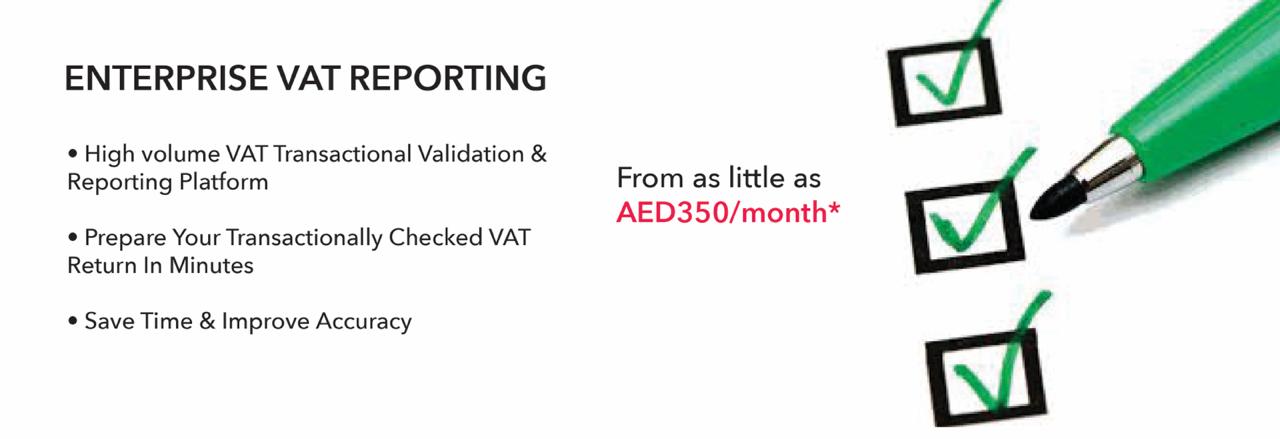

Enterprise VAT Reporting

Our service is inclusive of a state of the art platform to transactionally validate 1000’s of VAT postings to provide greater confidence to your VAT return.

We will work with you to significantly reduce the time required to prepare your VAT return, saving you significant costs and allow you to prepare a 100% transactional checked VAT return in minutes.

PROMOTIONAL OFFERS

As a busy financial or tax professional, preparing an accurate VAT return can be challenging if you have thousands of transactions from your IT system.

Save 50% from your time spent on VAT reporting, costs and improve the accuracy of your returns by 60%.

Enterprise VAT is an easy to use service that will check all your transactional data against our VAT library, identify error postings and prepare your VAT report.

*Initial Consultation is FREE

OUR DIFFERENCE

What Sets Our Service Apart

Experienced Advisors

No Impact to IT Systems

Complex Tax Group Support

VAT Reporting Engine

Saves Cost & Time

OUR EXECUTION

How We Deliver

Preparation

We set up your service to define your transactional scenarios and tax codes for accurate processing.

Processing

Our state of the art platform can process 10,000’s of entries in minutes and identify possible errors for review.

Reporting

Generate an online report which you can confidently submit to the FTA.

Want to Improve Cost & Performance?

We’ll provide best practice quality processes, expertise and platforms to run your business more effectively.

![]()

VAT & Tax Resources

UAE Corporate Tax – Immediate Actions & Guide For Businesses

The introduction of the UAE corporate tax guide requires your businesses to conduct an assessment of the impact on your legal and financial structure.

UAE VAT Registration – Comprehensive Guide For Businesses

As a UAE business or individual receiving commercial consideration, UAE VAT Registration is mandatory if your taxable supplies exceed AED375,000 in 30 days.

MoF Issues Corporate Tax Guide on Small Business Relief

The Guide provides further updates and specific reliefs to support start-ups and other small or micro businesses by reducing their corporate tax burden and compliance costs.

TESTIMONIALS

FAQ’S

Will we assess your prior VAT returns?

Yes. Our scope can include an analysis of prior returns to highlight reporting and filing errors for correction.

How do we price our service?

We provide a fixed price to our service. This is dependent on the volumes and complexity involved.

Can we look at your accounting systems set up?

Yes. We will review the implementation of your ERP/Accounting system for tax configurations provide recommendations to improve automation and possible provision of the FTA Audit File.

Will we review your processes and identify improvements?

Yes. We will assess account receivables, VAT report preparation, and especially payables processes. Any risk, efficiency, and training gaps will be highlighted to improve future operations.

Will we provide a report and discuss any findings?

Any findings and recommendations are documented and presented to provide all internal stakeholders areas of focus and attention. If implementation support is required, we can also provide this as an extra service.

LET US SIMPLYSOLVE IT FOR YOU

Schedule a Consultation

Whether you have an existing Finance, Tax, HR, & IT function operating its own system and process or a small company needing a complete outsource services, we have the flexibility to serve your business.

Mon - Fri: 9am-6pm, Sat - Sun: Closed

Copyright © 2024 | SimplySolved | All Rights Reserved.

Simply Solved is the partner you need to get your tax registration done and get the administrative tasks of accounting done in a timely and professional manner. Their dedicated account managers make the whole effort easy and painless.

Simply Solved is the partner you need to get your tax registration done and get the administrative tasks of accounting done in a timely and professional manner. Their dedicated account managers make the whole effort easy and painless.